Human sideof innovation

We empower fintechs to challenge the financial status quo.

Trusted by:

Human sideof innovation

Introduce your business to the digital reality through

the use of modern and advanced INCAT solutions, tailored to your individual needs. Save time and money by gaining a competitive advantage in the market.

Why work with us?

SOLUTIONS FOR FINTECHS AND CHALLENGER BANKS

We are aware that the fintech industry is demanding and needs solutions based on the latest technologies, which is why we create flexible and comprehensive transaction systems tailored to the requirements of financial entities.

MODERN OUTSOURCING

It is essential to have an experienced IT team, which is why we have created CoLab – a modern outsourcing model in which we take responsibility for the project, while you have control over its progress and copyright.

WIDE RANGE OF TECHNOLOGY

Technology is constantly evolving, and so are our teams, which specialise in creating advanced systems. Thanks to this, we can guarantee to provide modern services at the highest level.

Our specialization

Solutions for the banking and fintech industries

We have created a unique and rapidly scalable transaction system for the fintech and banking industries, which will let you manage your product offer and service parameters flexibly and in real time.

Software creation and development

We create applications and advanced systems using technologies such as AI or machine learning. Choose innovative IT solutions that will give your business a competitive edge.

IT outsourcing

We cooperate within three models: Body Leasing, Team Sharing, and the most advanced – the CoLab formula.

Our products

BOS

BOS is a modern transaction system intended for technologically advanced organizations from the fintech sector as well as challenger and neo-banks. Our solution enables efficient and effective management of transaction processes based on a scalable microservices architecture.

INCAT FaaS AI

FaaS AI is a transaction platform created in the SaaS model

and based on advanced machine learning mechanisms.

It is suitable for starting fintechs, and challenger and neo-banks. The platform allows fintech startups to quickly validate their model and business idea.

Our services

Do you need programmers for your project? Choose IT outsourcing and benefit from experienced specialist assistance.

Additional specialist to support the team

You are running a project and your team lacks a person with the knowledge and skills necessary to implement it. Use the Body Leasing model and choose your specialist.

Dedicated project team

You need a specialised and well-organised technical team, but you do not want to involve company resources in its creation. Team Sharing will help you implement demanding technological projects.

Comprehensive project implementation

You are creating an advanced solution or application and you are looking for a technological partner with whom you can share the responsibility for the implementation of the project. Maintain full control over the design and copyright of the resulting solution using CoLab.

Our implementations

Client

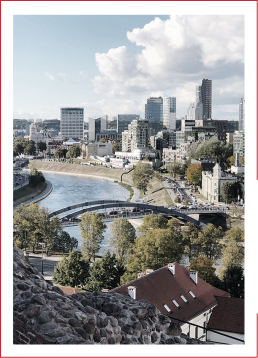

One of the most popular Lithuanian fintechs, a provider of applications for keeping accounts and handling payments.

Project

Payment application with virtual payment card, including currency exchange module, cashback and insurance for online purchases

Scopeof the project

International

Challenge

BOS as the main transaction system, acting as a comprehensive back-office for the mobile application offered by the client.

Scope of implementation

The implementation of BOS includes all back-end functions, in particular, customer data processing, account management, transfer and payment processing, and the full functionality of the General Ledger.

Result

4 months after its commercial debut, the client’s solution based on BOS is processing millions

of transactions per month.

Client

The client’s flagship project is a native cloud platform for retail and SME banking with advanced API technology.

Project

A platform, based on microservices architecture, made available to banking institutions through the public cloud.

Scopeof the project

International

Challenge

Implement a solution that will comprehensively process interbank transfers and fully integrate transaction information for Bank customers.

Scope of implementation

Implementation of BOS, which acts as a back office solution for payments, interbank settlements and a complex statement generation mechanism.

Results

The platform, based on the BOS engine, processes SEPA and SWIFT transactions and is responsible for processing hundreds of thousands of transactions for the statement generator.

Client

Polish fintech offering a platform that enables investment clients to offer digital wealth management products that can be easily customized and integrated with partners’ offerings.

Project

A platform for investment clients that can be easily customized and integrated with partner offerings. In addition to investment activities, the fintech offers account maintenance and interbank transfers and card payments.

Scopeof the project

Poland

Challenge

Implement a comprehensive trasactional system capable of full integration with the investment system.

Scope of implementation

Installation of BOS in the cloud, in the form of INCAT FaaS AI solution, covering processes such as bank accounts, execution of financial transfers, transaction records, general ledger and full integration with other components of the client’s IT architecture.

Result

The project is being prepared for commercial launch, the client has the necessary banking licenses and Small Payment Institution status.

Client

One of the first digital banks in Saudi Arabia

Project

Creating a cloud-based digital bank offering commercial banking products to customers, complying with local banking legislation.

Scopeof the project

International

Challenge

Deploy a single instance of BOS as an INCAT FaaS AI service to launch the bank’s commercial offering.

Scope of implementation

BOS system components, installed in a public cloud, covering customer and account data processing, transaction, card and payment processing. As a technology partner of the project, we are also responsible for assembling and delivering a project team, experienced in developing IT solutions in the fintech and banking industry.

Result

The project is at the stage of launching MVP covering the business area of payments with bill processing, cards and card payments, and domestic and international transfers. In subsequent stages, the savings and credit areas will be launched.

Client

Internal project

Project

INCAT’s internal project, a transaction platform that acts as a sandbox for fintech startups, challenger banks and digital banks. The platform, in the form of a service, enables the efficient implementation of all processes necessary for the launch of financial services.

Scope of the project

International

Challenge

Development of a transactional platform in the form of a service, dedicated to start-up, modern financial institutions, which allows for fast and cost-optimal commercial implementation of a financial product.

Scope of implementation

Installation of BOS components in the public cloud, in the form of INCAT FaaS AI solution, using Machine Learning technology in AML, anti-fraud and KYC modules.

Result

The INCAT FAAS AI platform is already being used in two commercial financial services implementations.

Client

International technology company based in Switzerland

Project

Outsourcing of IT team in Team Sharing model

Scope of the project

International

Challenge

Recruit, establish and maintenance project teams with unique technical competencies

Scope of implementation

In the Team Sharing model, INCAT is responsible for the recruitment process, matching of technical competencies, organization of work and maintenance, development and evaluation of project teams

Result

We have worked successfully with the client for 3 years, regularly supplying individual specialists and completing full project teams with the technology stack required by the client

Client

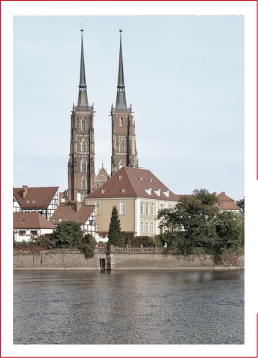

One of the first Polish commercial banks

Project

Development and maintenance of internet banking for individual and business customers

Scope of the project

International

Challenge

Recruit, establish and maintenance project teams with unique technical competencies

Zakres współpracy

In the Team Sharing model, INCAT is responsible for the recruitment process, matching of technical competencies, organization of work and maintenance, development and evaluation of project teams

Result

Project teams delivered by INCAT are successfully developing the client’s electronic banking area by implementing and optimizing the system for consumer lending

Let's talk

Let's meet

INCAT Sp. z o.o.

ul. Braniborska 40,

53-680 Wrocław

e-mail.: info@incat.com.pl